FOX Business’ Susan Li breaks down the big week for the big tech companies including Apple and Facebook, Tim Cook’s economic outlook and Mark Zuckerberg saying there’s no end in sight as to when Facebook will bring employees back into the office.

Apple, the maker of iPhones, has toppled the world’s biggest company in value, despite the coronavirus pandemic.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 425.04 | +40.28 | +10.47% |

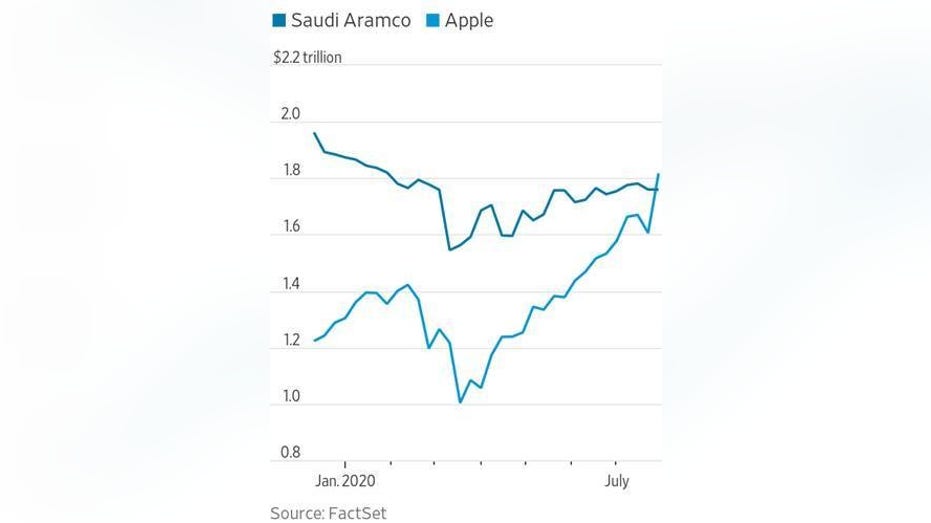

Friday, Apple’s stock closed at an all-time high of $425 and change with a market cap of $1.8 trillion, as tracked by the Dow Jones Market Data Group. For the year, shares have advanced 44.7 percent to a fresh record. Conversely, Aramco’s stock is down 6.4 percent since the end of December.

BIG TECH CEOS DIVIDED ON CHINA TECHNOLOGY THEFT

Aramco, Saudi Arabia’s majority state-owned oil conglomerate’s market value sits at $1.7 trillion. The price of oil has been hammered in the global pandemic as airlines and cruise lines came to virtual standstills amid the height of the coronavirus and with many consumers continuing to work from home and limiting automobile travel.

Apple reported a blowout quarter on Thursday posting an 11 percent jump in revenues to $59.7 billion exceeding Wall Street estimates, despite 25 percent of global stores still closed.

APPLE TO SPLIT STOCK FOLLOWING BLOCKBUSTER EARNINGS

And in an extra bonus, it unveiled a four-for-one stock split that may entice a new crop of investors. The move is offered “to make the stock more accessible to a broader base of investors,” according to the earnings release.

At the close of the market on August 24th, each Apple shareholder of record will get three extra shares for every share held. Split-adjusted trading will begin on August 31. Apple previously had a 7-for-1 stock split in 2014.

Photographer: David Paul Morris/Bloomberg via Getty Images

In another broad bullish sign, CEO Tim Cook, in an interview with FOX Business, said he is optimistic the U.S. economy is headed for a strong rebound.

“I’m still bullish because we went into this very strong. And I think, I think more stimulus is required, but I’m optimistic that will occur. And yeah I do, I do think that we can, we can have a strong bounce-back” said Cook.